Agricultural futures are contracts that help traders to obtain or sell commodities at predetermined prices, serving as tools for hedging against price volatility and speculating on potential market trends.

Orange Juice Trading entails futures contracts traded over the ICE, exclusive among the agricultural commodities due to their processing requirements and perishability. These futures allow producers, distributors, and shops to hedge versus price volatility caused by elements like climatic conditions affecting orange crops in important producing regions like Florida and Brazil, fluctuations in global demand, and adjustments in export guidelines.

Traders can filter their hunt for tools determined by variety, together with market data and reports or interactive tools, within the CME Team’s assets. Making use of these tools allows traders to navigate global markets much more effectively and capitalize on international opportunities.

*The listing of countries introduced will not be exhaustive. Info on extra nations is often furnished if required because of the consumer.

The background of modern futures trading is usually traced to 1730 once the Dojima Rice Trade was established in Japan for the goal of trading rice futures.

Oats also are attaining traction as much more sustainable crop as compared to other grains. This is because oats have to have a lot less water and also have a reduce carbon footprint, which allows in lessening greenhouse fuel emissions.

Some profit examples are determined by hypothetical or simulated trading. This suggests the trades are usually not genuine trades and rather are hypothetical trades determined by real market prices at time the recommendation is disseminated. No precise funds is invested, nor are any trades executed. Hypothetical or simulated performance is not really necessarily indicative of upcoming effects. Hypothetical performance outcomes have numerous inherent limitations, a few of which might be explained underneath. Also, the hypothetical results usually do not include things like the costs of subscriptions, commissions, or other fees. Since the trades fundamental these illustrations have not really been executed, the outcome could understate or overstate the impact of particular market factors, like insufficient liquidity.

Diversifying money resources by cultivating various crops and livestock may mitigate risks. Partaking with agricultural specialists can provide valuable insights and strategies tailor-made to precise risk exposures.

Higher liquidity: Most futures markets have high liquidity, which enables traders to enter and exit the market if they wish to.

Hedge your existing positions: You website should use futures to hedge your publicity inside the stock market. By way of example, if you possess shares in companies in the Nasdaq one hundred and are worried about their value dropping, you may quick a Nasdaq one hundred index long term – the profits from which might with any luck , offset a proportion of the share placement losses.

That you are using an out-of-date browser To get a certain quality of experience we intensely advocate using among

Freezing Possibility: For extended shelf existence, rolled oats can be saved from the freezer. Assure They can be in an airtight bag or container and eat within 1 calendar year.

Every one of the strategies are taken from our key web site on this Web-site exactly where We've got free and profitable trading strategies.

Margin isn't obtainable in all account kinds. Margin trading privileges are matter to Webull Financial, LLC review and acceptance. Leverage carries a superior level of risk and is not suitable for all investors. Increased leverage produces better losses while in the function of adverse market movements.

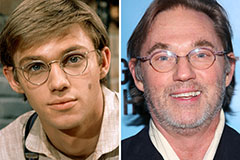

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now!